|

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review laws and their interpretation to assist businesses (and consumers) in planning. If you have questions, then please speak to your legal professional or the appropriate regulatory authority. Earlier this week, the Federal Trade Commission issued a final rule (link) effectively banning non-compete agreements for most workers nationwide. This significant development has wide-ranging implications for employers and employees across all industries, including the food and beverage sector. The rule is linked above, but fair warning, the rule and discussion are over 500 pages long, so get your pajamas and chamomile tea ready. WHAT DOES THE FINAL RULE DO?Long story short, the FTC's final rule prohibits employers from enforcing non-compete agreements with most workers after their employment ends. Of course, non-compete clauses typically restrict employees from taking jobs with competitors after leaving a company. WHY ISSUE THE FINAL RULE?President Biden's 2021 Executive Order on Promoting Competition in the American Economy specifically called on the FTC to address non-compete agreements. The FTC's recent rule can be seen as a response to that directive. The FTC’s rational against non-compere agreements is that they stifle competition in two key ways:

WHO DOES THE RULE APPLY TO?The ban applies to a broad range of workers, including those in the food and beverage sector:

WHO DOES THE RULE NOT APPLY TO?There are exceptions for non-profit enterprises, for those selling a business, for agreements enforced where the cause of action accrued prior to the rule’s effective date, and for "senior executives." However, the bar for this senior executive exemption is quite high. It applies only to those who:

DOES IT ONLY APPLY TO NONCOMPETES?Yes and no. Yes, it does only apply to non-competes on its face since it does not ban NDAs or non-solicitations agreements. But the rule does say that it could ban these other kinds of restrictions when they have the same functional effect as a non-compete would. So, maybe there’s an NDA or non-solicitation agreement that cover such a large amount of information or customer base that effectively prevents someone from working in their given field. WHEN DOES IT TAKE EFFECT?So, as of right now, noncompete agreements are still in effect. When the rule does take effect (if it does, and it’s a big if), it will be retroactive - which means that the rule bans new non-competes after the effective date, but also invalidates existing non-competes subject to few exceptions. But as to an effective date, in short, we don’t know. Two big things that will impact the implantation of the rule:

WHAT CAN F&B BUSINESSES & EMPLOYEES DO RIGHT NOW?

ABOUT BROOK BRISTOWBrook Bristow focuses his practice on alcoholic beverage law and commercial matters. Representing hundreds of clients from small start-ups to national brands, Brook counsels those in the food and beverage industry such as breweries, wineries, distilleries, distributors, and retailers. He regularly advises on federal and state regulatory compliance, licensing, contracts, intellectual property, and federal label and formula approvals, among other topics. He enjoys central coast zinfandel, aged rum, and can brew a passable IPA. You may reach him directly at [email protected]

0 Comments

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review the alcohol beverage laws and their interpretation to assist businesses (and consumers). If you have questions, then please speak to your legal professional or the appropriate regulation authority. PERSONAL DISCLAIMER: I had the privilege of writing several brewery bills during the 2013-2019 timeframe and advocating for their passage. I was not asked to participate this time around, so I don’t have many personal insights or thoughts to share on the discussion points, negotiations, or other context of the new laws. This will just be straight analysis of what the new laws are and what they do and don’t do. TL;DR: SOUTH CAROLINA BREWERIES WITH MULTIPLE SITES CAN NOW TRANSFER BEER TO THEMSELVES. BUT, THERE'S A CATCH OR TWO.Today, we'll tackle part two of the newly legal South Carolina Craft Beer Economic Development Act. It covers a South Carolina brewery's ability to transfer its own beer to itself in the event that it has multiple brewery locations within the state. TRANSFER BETWEEN BREWERIESOf the 139 breweries and brewpubs in South Carolina, there are a quite that have multiple locations. By our count, there’s about 15 of these right now, with a few more on the way. Because brewpubs are not eligible to ship or otherwise transfer their beer, that means that we're really talking about 123 breweries. Since 15-ish companies are impacted, that's roughly 12% of the total, but 24% if you factor in their second location, which would be 30 locations. So, theoretically, before taking restrictions into account, this will impact nearly a quarter of all of the state's breweries. So, what is the deal with transfer and why does it matter? Well, Federal law allows breweries to transfer beer between themselves when they have multiple locations under an umbrella. The rationale being that the company or affiliated companies own the beer, so therefore, they should be able to allocate it however such companies see fit. The federal law also allows collaborating breweries to transfer that beer between them. Also, currently for state breweries to get their beer from their other brewery, they have to sell it and purchase it back from a wholesaler. The law does allow the wholesaler to allow for a bulk discount on the beer, but that does come with conditions. And this will still be the case for breweries who don't qualify under the new law. But now for the first time, South Carolina has a transfer law on the books. In short, it says that breweries in South Carolina that have multiple locations will now be able to transfer beer between those locations without having to buy it back from a wholesaler, but two things: 1. Both locations have to have the exact same ownership. That is going to mean the same company, with the same owners, with the same percentages for each location. For example, let's say ABC Brewing has two locations—one in Greenville and one in Bluffton. Each location is licensed, but has different LLCs for each location. That wouldn't qualify. Instead, their LLCs, owners, and shares would have to be exact. While not perfect for breweries looking to limit liability per location, the new law ensures that transfer is for a company rather than companies with potentially varying owners or ownership groups. 2. The other restriction is that a brewery cannot receive more beer than it makes on an annual basis. So, for example, if you have a brewery that is basically a pilot system that is rarely used and is effectively a taproom, then they’d only be able to receive from another location what their pilot system makes. If that’s just 10 barrels of beer a year, then that’s what it could receive. The bigger brewery, meanwhile, could receive as much as it made. The rationale here is what has previously been described in South Carolina as the Budweiser problem - that a massive brewery could just open up a series of taprooms with pilot systems, never use them, and effectively skirt the three-tier laws by self-distributing to themselves. The new law prevents that occurrence. Brook Bristow focuses his practice on alcoholic beverage law and commercial matters. Representing hundreds of clients from small start-ups to national brands, Brook counsels those in the food and beverage industry such as breweries, wineries, distilleries, distributors, and retailers. He regularly advises on federal and state regulatory compliance, licensing, contracts, intellectual property, and federal label and formula approvals, among other topics. He enjoys central coast zinfandel, aged rum, and can brew a passable IPA. You may reach him directly at [email protected]

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review the alcohol beverage laws and their interpretation to assist businesses (and consumers). If you have questions, then please speak to your legal professional or the appropriate regulation authority. PERSONAL DISCLAIMER: I had the privilege of writing several brewery bills during the 2013-2019 timeframe and advocating for their passage. I was not asked to participate this time around, so I don’t have many personal insights or thoughts to share on the discussion points, negotiations, or other context of the new laws. This will just be straight analysis of what the new laws are and what they do and don’t do. TL; DR: SOUTH CAROLINA BREWERY TO-GO LIMITS ARE INCREASING BY 200%Today, we tackle the first portion of the new law, which will focus on to-go sales. Tomorrow, we’ll talk about the new transfer provisions. TO-GO SALESLet’s go ahead and get the elephant in the room out of the way. Yes, the rumors are true. South Carolina breweries can now sell kegs. Well, kegs of a certain size shall we say. The new law states that a consumer may purchase up to 864 fluid ounces of beer per person per day from a licensed brewery. Remember, licensed brewpubs have no to-go limitation. How much is 864 fluid ounces in practical terms? That’s three cases (24 cans) of 12 fluid ounce cans. Or fifty-four 16 fluid ounce cans (2 cases, and a six pack). Or just short three cases of 375ml bottles. Or twenty-seven 32 fluid ounce crowlers. Or, yes, a sixtel of beer (which is about 660 fluid ounces), and then 17 twelve fluid ounce cans on top of it. Previously, the law allowed for 288 fluid ounces to go (one case of 12 ounce cans). That had been on the books since 2010, but had been doubled to 576 fluid ounces for a short time during the pandemic as a helping hand to breweries. The temporary provision went away in 2022. Breweries are not being mandated to sell kegs. They can sell in whatever containers they wish up to the limit. But for those that do, there is of course going to be paperwork which consumers will need to fill out at the brewery (there’s always paperwork) that will be kept on file. Consumers will need to provide their driver’s license and a deposit on the keg. The brewery will tag the keg according to statutory specifications and need to meet certain requirements. If you’re curious, here are the current to-go limits for breweries in nearby states: Georgia: 288 fl. oz. Mississippi: 576 fl. oz. Alabama: 864 fl. oz. North Carolina: No Limit The only other change from prior law (which we’ll cover more in depth tomorrow) will be that breweries can sell to-go both the beer that they brew on-site and beer they receive from one of their other locations if they have another location that qualifies for a transfer. That’s important because now breweries might be able to begin splitting operations between clean and sour, barrel aged and non barrel aged, or other distinctions (like some had done already), but retain the option of selling that beer from the other location without having to purchase it back from a wholesaler. Brook Bristow focuses his practice on alcoholic beverage law and commercial matters. Representing hundreds of clients from small start-ups to national brands, Brook counsels those in the food and beverage industry such as breweries, wineries, distilleries, distributors, and retailers. He regularly advises on federal and state regulatory compliance, licensing, contracts, intellectual property, and federal label and formula approvals, among other topics. He enjoys central coast zinfandel, aged rum, and can brew a passable IPA. You may reach him directly at [email protected]

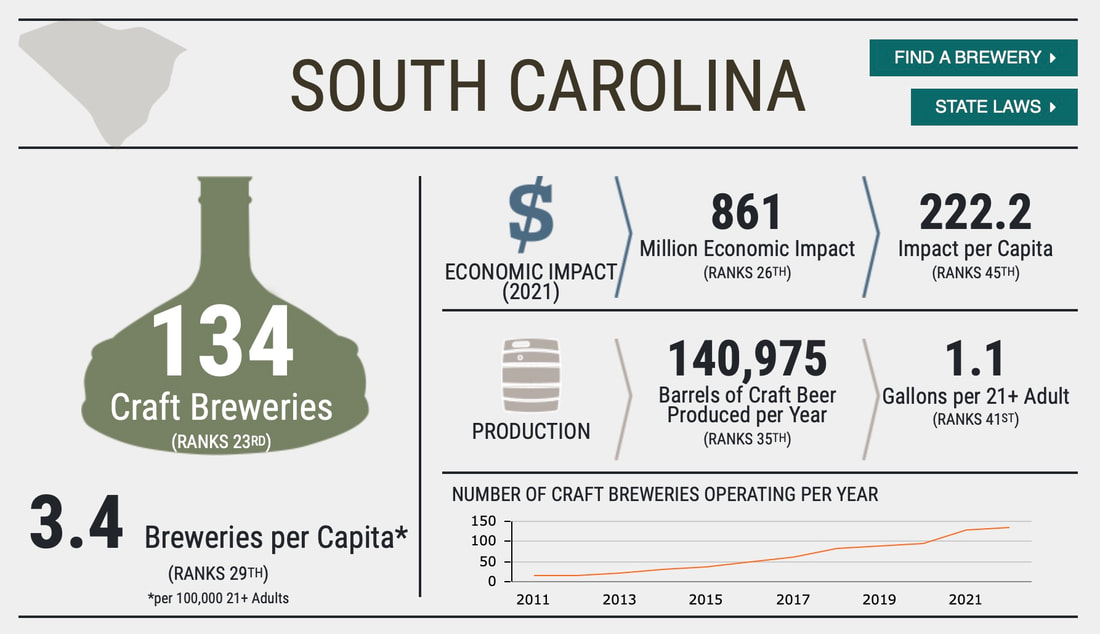

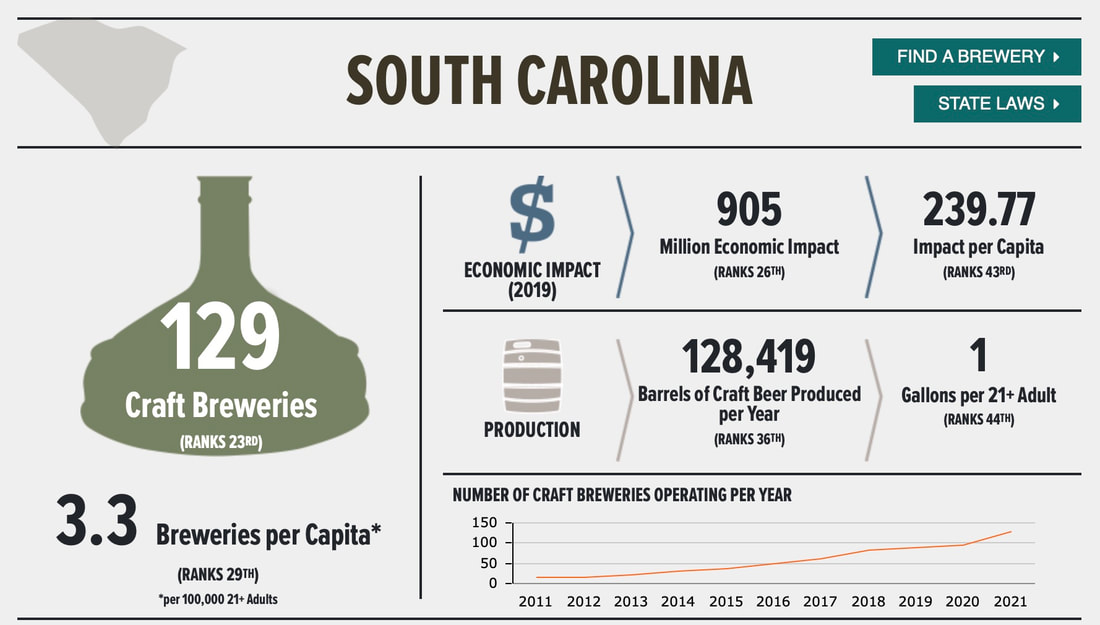

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review the alcohol beverage laws and their interpretation to assist businesses (and consumers). If you have questions, then please speak to your legal professional or the appropriate regulation authority. TL;DR: BEFORE WE GET INTO THE NEW LAWS, LET'S REVIEW WHERE WE ARE.There are new brewery laws on the books in South Carolina for the first time in several years! And over the next few days, we’ll take a look at what they are, what they do, what they don’t do, and what’s going to happen next. But before we get into any legislative analysis, I thought it might be helpful to take a look at where things are now in the state overall and then preview the new laws. So, let’s take a look at some statistics and colorful images. STATISTICSWhat you see above is information from the Brewers Association, the national trade group who compiles such statistics. As you see, South Carolina has come a long way in the last ten years, but its economic impact and production numbers are in the middle nationally. According to the stats, there are 134 breweries in the state. But, actually, it’s more. I went into the state licensing database, and we actually have 124 breweries and 16 brewpubs. In total, that’s 140! (If you want to get technical, though, the number is really 139 breweries due to one being closed.) If you want to compare that to when the Pint Law happened in 2013 (can you believe that it has been nearly 10 years?), that’s an increase of nearly 1,000%. Crazy. To break it down a little further: Brewpubs: 16 Pint Law Breweries: 13 Stone Law Breweries: 111 As a refresher, here's what each of those can legally do (note: this is prior to the new law's application). Brewpubs South Carolina brewpubs can do the following things:

South Carolina brewpubs can’t do the following things:

Pint Law Breweries *Note: I'm calling them Pint Law breweries, since that's the law they fall under from 2013. Effectively, to simplify, these are the breweries that don't have food operations, guest beer, wine, or liquor. Pint Law breweries can do the following things:

Pint Law breweries can’t do the following things:

Stone Law Breweries *Note: I'm calling them Stone Law breweries, since that's the law they fall under from 2014. Effectively, to simplify, these are the breweries that have food operations, guest beer, wine, and/or liquor. Stone Law breweries can do the following things:

Stone Law breweries can’t do the following things:

PREVIEW OF THE NEW LAWSNow that we've talked about what the prior laws were, let's preview the new laws and the objective. Introduced in February, the South Carolina Craft Beer Economic Development Act as originally written sought to do four things: (1) allow limited self-distribution; (2) increase to-go limits; (3) change special event licensing; and (4) allow for transfer of beer between breweries. Why are those important? 1. Self-Distribution: Well, currently, breweries have to sell their beer to a wholesaler who then sells it to a retailer. Self-distribution allows breweries to do that themselves whereby they get to have better margins. 2. To-Go Sales: With the exception of a brief doubling of to-go limits during the pandemic, breweries have been operating under a law from 2010 that allowed one case of 12 fluid ounce cans of beer to-go. 3. Special Events: Revisions to special event licenses were wanted because breweries aren't allowed to pull their own special event permits. So, you won't see a brewery pouring at a farmers market unless it is licensed by someone else, as an example. 4. Transfer: Breweries that have multiple locations aren't allowed to send their own beer to themselves. While federal law allows it, South Carolina law provided that a brewery had to sell that beer to a wholesaler, and then the brewery would have to buy it back. Granted, the law did allow for a bulk discount, but with more breweries opening second locations, it was important that they have more freedom. During the legislative process, allowance of self-distribution and the revisions to special event licensing were cut loose from the bill. Effectively, the bill was then about two topics - increasing to-go limits and bonded transfer of beer. Remember, all breweries were subject to the 288 fluid ounces per person per day rule. Topics not addressed included excise tax reduction, franchise law reform, allowance of satellite taprooms, and changes to brewpub laws. But those will most likely come up down the road as the industry continues to grow. The original bill was introduced in February and was signed by the Governor earlier this month. The bill had little issue passing both the House and Senate, as it sailed through the senate by a vote of 40-1 and the House by a vote of 103-0. Big wins. Tomorrow: we'll tackle to-go sales and talk about what those will mean moving forward. Brook Bristow focuses his practice on alcoholic beverage law and commercial matters. Representing hundreds of clients from small start-ups to national brands, Brook counsels those in the food and beverage industry such as breweries, wineries, distilleries, distributors, and retailers. He regularly advises on federal and state regulatory compliance, licensing, contracts, intellectual property, and federal label and formula approvals, among other topics. He enjoys central coast zinfandel, aged rum, and can brew a passable IPA. You may reach him directly at [email protected]

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review the alcohol beverage laws and their interpretation to assist businesses (and consumers) in planning. If you have questions, then please speak to your legal professional or the appropriate regulation authority. TL;DR: HEY, IT'S HURRICANE SEASON. TIME TO GET MOVING.We’re in the thick of Hurricane season. And as Hurricane Ian approaches, we hope that everyone in the potential impact zone is working to get prepared. Being based in South Carolina, we are very concerned for many of our friends and clients as the storm approaches. While everyone’s list of things to do might vary, we just wanted to offer a few things to add to the checklist, particularly if you own an alcohol related business. And this list applies for this storm, as well as any others that might roll our way this hurricane season (until November 30th) - which, if history is any indication, is fairly likely. So, before you throw that hurricane party, make sure you take care of the things listed below. PREPAREDNESS TIPS 1. WATER. All of our producer clients in the range of a hurricane should consider filling kegs and/or empty fermenters with water in case of a shortage. Remember that generally, hurricanes can knock out electricity for some time and on top of that, water service may be unreliable due to flooding. Consider filling empty growlers or empty wine and spirits bottles with fresh water. Many breweries and/or retailers might be offering fresh water in kegs and/or growlers, but plan ahead. 2. DOCUMENTS/BACKUP YOUR DATA. Businesses should gather important hard copy documents and put them in a safe container, and either take them with you or at least put them in a secure location. If you can’t take the documents with you, then use plastic bags and duct tape. Put documents in at least gallon-size Ziploc bags. Duct tape all bags closed. Important documents can vary, but these would include licensing paperwork, insurance policies, tax returns, and contracts. Additionally, ensure that data is backed up and that any backup is performed in a timely manner and that any storage is done somewhere that is safe, secure, and dependable. 3. PHOTOGRAPHS. Before a storm, take photos of every room at the business (or home), every piece of electronics, and everything valuable, including documents. Upload the pictures to the cloud. Also make sure that your contacts are uploaded to the cloud. 4. INSURANCE. Review your business (or home) insurance policy to make sure you have coverage for any storm damage to the business. Remember, flood insurance isn’t covered under standard policies. Also look at wind and hail storm coverage. Certainly, if you aren’t insured, then the bad news is that a policy can't be procured in the time needed. However, having knowledge of what your policy says can be beneficial in preparing for what you need to do and how you will need to proceed on a claim after the storm. 5. STORAGE. In terms of storing product, it is best to store it in a place above the ground in the case of flooding. Certainly, this might not be practical for keg storage. However, if you have shelving and can afford to move product, ingredients, or other merchandise off of a low area, then that would be beneficial. 6. PROTECTION. You can’t move your equipment, but you can prepare your building for potential flooding if you are in a flood plain. Local authorities should have information regarding sand bags. You’ll probably already know what your drainage situation is, but look into generators to operate certain pumps. This would be helpful in keeping the lower levels of a facility clear of flood waters. Boarding up of windows and other vulnerable apertures can protect the building from any high-speed debris that is flying during the storm. 7. PLANNING. In terms of making a true hurricane plan, please consult the authorities and experts and what is recommend for the aftermath. But, please start now if you haven’t. There are many great resources out there. Please remember that a hurricane is not the only threat to assess. You also should be concerned about tornadoes, fire, flooding, and looting. Part of this plan would include following meteorologists in your area regarding the latest information and forecasting. We happen to have one in our family who currently serves the Upstate, but has also worked in the Grand Strand, Midlands, and Lowcountry, and so we would highly recommend Chrissy Kohler. 8. GOVERNMENT OFFICES. After a storm, it is anticipated that SC state government offices might be closed for a day or so, and possibly more. If you need anything quickly from DOR, DHEC, or other government offices that you usually work with, it is best to move quickly when you know a storm is on the way. 9. COMMUNICATIONS STRATEGY. It should be kept in mind that normal functions could be interrupted by a storm and any flooding occurring after. Establish backup communications and have a plan to restore them. Some options would include cell phones, radio, and walkie-talkies. Identify a communications contact within your business who can communicate any necessary information to employees. 10. EMPLOYEES. If you’re located in a coastal county in South Carolina, then please note that the government probably will ordered an evacuation if a hit looks to be fairly direct - or even strongly indirect. Not everyone will heed this warning, and many will stay in the area - with many businesses staying open before and after the storm. Many employees will heed the warning and leave the impacted areas. Many jobs on the coast revolve around food and beverage, which means those jobs (for the most part) are going to be non-union private sector jobs. That means that employers have enormous flexibility when dealing with employees during a storm. Employees wishing to evacuate can be disciplined by employers for failing to show for work should the business stay open and the employer directs the employee to come to work. Of course, the likelihood of that for evacuating is low, often because it isn’t a good look for employers. But, this is more reason to communicate well with employees before and after the storm. Stay safe, everyone. BROOK BRISTOWBrook Bristow is a South Carolina-based lawyer at Bristow Beverage Law, who primarily counsels companies in the alcohol industry on business and employment laws, as well as on compliance, licensing, and intellectual property. You may reach him directly at [email protected]

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review the alcohol beverage laws and their interpretation to assist businesses (and consumers) in planning. If you have questions, then please speak to your legal professional or the appropriate regulation authority. TL;DR: SC BREWERY TO GO LIMITS JUST DECREASED TO LIMITS SET IN 2010Unlike many states during the pandemic, South Carolina didn’t make many regulatory allowances for alcohol businesses. The reasons for this are fairly complex and get into the state’s constitutional powers and the lack of specific regulations as opposed to statutes, which there are plenty of. But, to sum it up, the state could only suspend regulations, not statutes. And for the most part, just about everything involving breweries was in the statutes. But regardless, breweries were at least declared to be essential businesses and were able to be open to the public while following the guidance provided to restaurants. They were also allowed to bring alcohol curbside for pickup. But, in late 2020, the General Assembly enacted some relief by changing the law to allow breweries the ability to sell up to 576 ounces of beer per person per day for to-go sales. That was a doubling of the prior limit of 288 ounces, which had been the law since 2010. This meant that breweries could sell just short of a sixtel of beer to a consumer. The 2010 law was based on the assumption that breweries would sell using 12 ounce cans, and so a case limit was passed. As the industry has matured, obviously, more breweries use pint sized (16 ounce) cans now, so the 2010 law actually prohibits them from selling a full case of those beers (384 ounces). While the 576 ounce limit was a dramatic increase over the prior limit, there was a limitation: it was only good until May of 2021. But, the provision ended up being extended for another year until May 31, 2022. Unfortunately, the General Assembly did not further extend the provision this year, or amend it, so as of June 1st, South Carolina breweries are back to the 2010 law which only allows for up to to-go sales of 288 ounces per person per day. How much is 288 ounces in practical terms? That’s one case (24 cans) of 12 ounce cans. Or eighteen 16 ounce cans. Or just short of a case of 375ml bottles. Or nine 32 ounce crowlers. If you’re curious, here are the current to-go limits for breweries in nearby states: Georgia: 288 ounces Mississippi: 576 ounces Alabama: 864 ounces North Carolina: No Limit While we don’t know how much the increase helped the state’s breweries, it certainly could not have hurt as brewery economic impact has increased, as have openings, although at a slower pace than previously. We don't know what's ahead on to-go sales when the General Assembly comes back in January, but, we do believe that further deregulation is needed to allow these businesses to be competitive with our neighbors who previously had lower limits than South Carolina up until a few years ago. BROOK BRISTOWBrook Bristow is a South Carolina-based lawyer at Bristow Beverage Law, who primarily counsels companies in the alcohol industry on business and employment laws, as well as on compliance, licensing, and intellectual property. You may reach him directly at [email protected]

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review the alcohol beverage laws and their interpretation to allow you and yours to have the crunkest spring break eva. If you have questions, then please speak to your legal professional or the appropriate regulation authority. Seems like a lot of people are on spring break this week and having a great time. And we are too. At least for the five minutes it took to go through our photo bank to find the picture above to make it seem like we were also on spring break and wishing we were. But, that being said, it is probably as good a time as any to remind you that South Carolina has specific alcohol laws as they relate to Spring Break (sorta, not really since they apply all of the time). But regardless, here are a few things to keep in mind if you’re going to be vacationing in the Palmetto State this Spring (or ever): 1. No alcohol is allowed on any public beach. So, pro tip: find a rich friend who is staying on a private one and have them call the guardhouse to let you in. 2. South Carolina has open container laws, so you can’t take alcohol that you’re actively drinking off of a licensed premises or in a vehicle. 3. Liquor stores are closed on Sundays. They also close at 7 p.m. on Saturday night. 4. Beer pong, flip cup, and other drinking games aren’t legal at bars, so better to play at home. 5. Even though the state’s alcohol laws don’t speak to hard seltzers specifically, they are treated like beer because that’s what the federal government does with them and they are regulated accordingly. So, yes, there are laws when you’re drinking claws. 6. You can still purchase mini bottles (less than 50ml) at many bars and restaurants. If you haven’t visited here since 2006, then hey, free pour like in your state! 7. You can’t buy liquor at grocery stores. A very few have gotten licensed to sell liquor in a separate suite of the building. But you won’t be able to ring up your vodka and OJ at the same time. You’ll have to step outside to a different store and enter into two transactions. So, good news for those with their step counters on. 8. Out for the night? Cool. You can order a drink at a bar or restaurant from 10 a.m. to 2 a.m. Monday through Friday. On the weekend, it’s a little more murkier. On Saturdays, where legal and assuming where you’re imbibing has the appropriate licensing, you’re still on a 10 a.m. to 2 a.m. schedule (although technically, it's until midnight and then Sunday morning from midnight until 2 a.m. and then not again until 10 a.m). On Sundays, it’s probably 10 a.m. to midnight, but remember that some municipalities do not allow for Sunday sales. If you’re catching brunch, just remember you can’t get that Bloody Mary until 10 a.m. in the municipalities that allow it. Same for you kegs and eggers. 9. Going out on a boat? If watercraft is licensed for alcohol, then remember that means the boat only, and not the dock, lot, or buildings around it. It also has to stay in the state’s waters for that three hour tour. 10. Heading to a wedding or other kind of social event while you’re here? Salute! Hope you brought your own alcohol, because if the hosts are providing it, then it can't be a cash bar that doesn’t have a special event permit. And if their choices aren’t up to par, then if you have a case of Heady Topper in the cooler, you’ll need to keep that on ice, because the law says you can only drink alcohol that was bought from a South Carolina retailer. Save it for the after party. Enjoy your stay! BROOK BRISTOWBrook Bristow is a South Carolina-based lawyer at Bristow Beverage Law, who primarily counsels companies in the alcohol industry on business and employment laws, as well as on compliance, licensing, and intellectual property. You may reach him directly at [email protected]

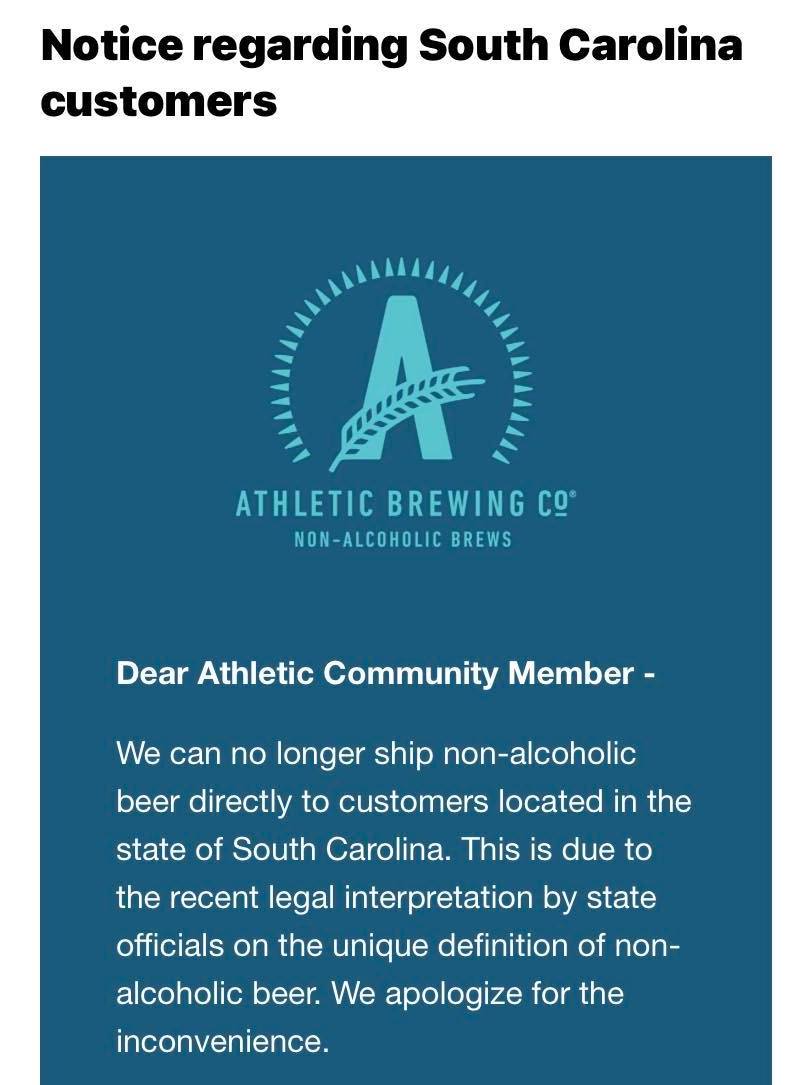

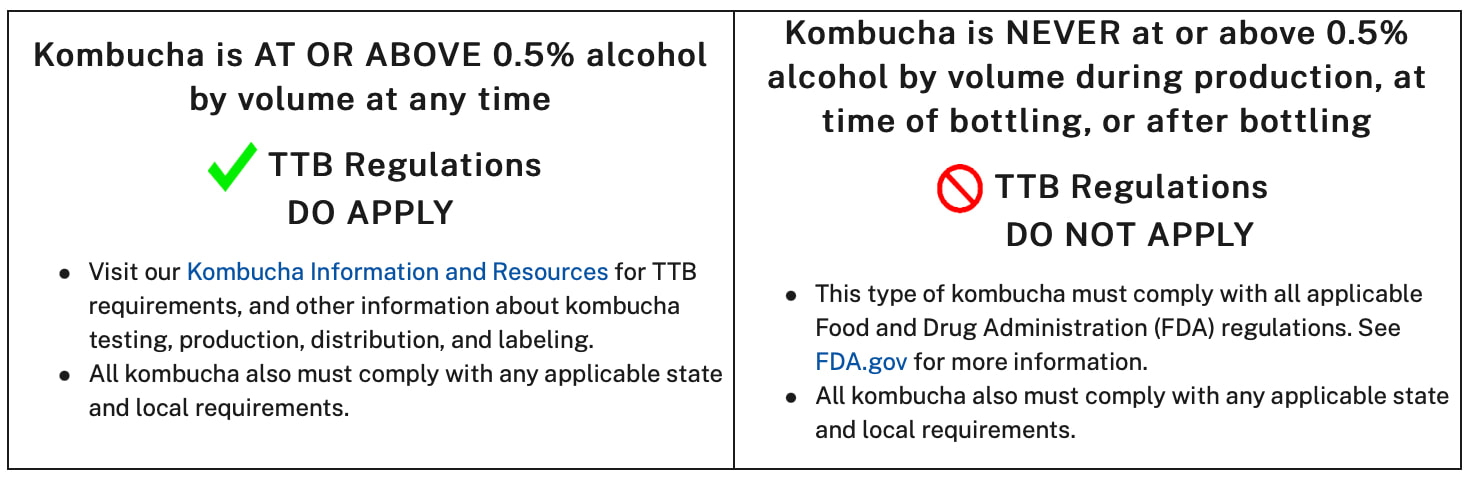

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review the alcohol beverage laws and their interpretation to assist businesses in planning. If you have questions, then please speak to your legal professional or the appropriate regulation authority. Like many, over the last week, you might have heard that non-alcoholic beer maker Athletic Brewing Co. suspended direct-to-consumer shipping of its NA beers to South Carolina due to “the recent legal interpretation by state officials on the unique definition of non-alcoholic beer.” Many were left scratching their heads and complaining about those darn archaic SC alcohol laws once again. But, that left some questions open: (1) What statute? (2) What interpretation? (3) What does this all mean going forward for NA producers like Athletic and other low alcohol producers, such as kombucha makers, their distributors, and retailers? We’d like to tackle that in this blog. BACKGROUNDThe statute at issue is S.C. Code Ann. 61-4-10, which defines what are considered to be nonalcoholic beverages in South Carolina. It reads as follows: The following are declared to be nonalcoholic and nonintoxicating beverages: (1) all beers, ales, porters, and other similar malt or fermented beverages containing not in excess of five percent of alcohol by weight; (2) all beers, ales, porters, and other similar malt or fermented beverages containing more than five percent but less than fourteen percent of alcohol by weight that are manufactured, distributed, or sold in containers of six and one-half ounces or more or the metric equivalent; and (3) all wines containing not in excess of twenty-one percent of alcohol by volume. Did that make sense? The statute says that that any beer below 6.5% ABV (5% ABW) is considered nonalcoholic? And beers packaged in 6.5 ounce containers up to 17.5% ABW (14% ABW) are considered nonalcoholic? And wines not in excess of 21% ABV are considered nonalcoholic? Huh? Yeah. It’s a little weird, right? All of those beverages clearly contain alcohol, so why would we consider them to be nonalcoholic? Well, we’ll leave that discussion for another day as it is definitely confusing on the surface. For the purposes of this discussion, however, let’s focus on the fact that it says “all beers . . . or fermented beverages containing not in excess” of 5% ABW as being nonalcoholic. Now, perhaps there’s some enterprising future business owners out there that read that and think, “Hey, why I don’t start making kombucha or a brewery featuring only session beers and not have to worry about licensing or taxes?” Well, that’s where the other part of this comes into play. There’s another statute: S.C. Code Ann. 61-4-500. And it says that “a person engaging in the business of selling beer, ale, porter, wine, or a beverage which has been declared to be nonalcoholic and nonintoxicating under Section 61‑4‑10 must apply to the department for a permit to sell these beverages.” In other words, if you want to sell nonalcoholic products, then you’re going to be regulated by the alcohol code, and you’ll need a permit from SCDOR to do that. And that’s exactly what SCDOR is saying in its interpretation. Side Note: this statute is also deemed to be what legalizes homebrewing and winemaking in South Carolina. But notice, while it legalizes wine up to near fortified status, legally, any homebrewed beer can only be up to 6.5% ABV. I did a blog on this years ago that has since gone away, but perhaps we’ll have a discussion about it soon. THE INTERPRETATION AT ISSUEWhile there isn’t an official communication or policy statement, SCDOR has apparently adopted internal guidance that has been provided to certain folks in the industry that says that the above two statutes bring NA beer and kombucha under their umbrella. That basically says that regulation starts at 0.0% ABV, because South Carolina statute doesn’t set a minimum threshold for alcohol content. So, in SCDOR’s alleged view, you are subject to regulation even if the alcohol content in the produced beer or fermented beverage is zero or small and/or you want to sell such beverages. Now again, this isn't official or published, but appears to be where things are headed. Perhaps something will be released soon. So, in summary:

BUT WHY KOMBUCHA?Why are we grouping kombucha with beer? Well, under the federal law, that’s how it is treated, so that’s what SC would do as well since our laws are silent on it by name. What’s most interesting about kombucha is that, if it’s under 0.5% ABV, then the Alcohol and Tobacco Tax and Trade Bureau ("TTB"), the federal entity that regulates breweries and alcohol as a whole, doesn’t regulate kombucha makers or make them subject to its regulations or require licensing. So, someone could potentially only have a state brewery permit and pay taxes to South Carolina, but yet have no responsibility to the federal government for the exact same thing on a product that isn’t even 0.5% ABV. But other fermented beverages would also fall under this interpretation as well. This could also complicate things for out-of-state producers, as they are required by the South Carolina application to provide their TTB approval. So, potentially, they could have to apply for a federal approval even if their products don't fall under the TTB's purview. That might not be worth it for them. Something else to consider: while this post isn't intended to be a full legal analysis, there is one item worth noting. The 21st Amendment. Yes, it repealed prohibition. But it also gave nearly complete authority over alcohol regulation to the states. But, many recent court cases giving interpretation to this have made clear that the authority of states is limited by various parts of the Constitution and only extend to "intoxicating liquors." The question would be are NA products and products under 0.5% which are not federally regulated considered alcohol enough to allow states the authority to regulate them under their alcohol regulatory powers? It's a very interesting question to pose here. WHAT DOES THIS MEAN AND WHAT COULD BE CHANGING?NOTE: SCDOR hasn’t confirmed anything yet beyond registration, but one would think if these businesses have brewery or beer producer permits, then they’d be treated as other breweries are which are subject to those same laws regardless of ABV for products. It's also possible a new permit is created for NA businesses. But that remains to be seen. There's also some interplay with the Department of Agriculture. They are the regulators for cottage foods - i.e., certain products that are made at home and sold at farmers markets directly to consumer. What’s a worst case scenario? Well, if beyond registration, alcohol laws are applied to them, then that could mean that producers need to cease production and sales. It could mean that their distributors won’t be able to sell any more of the producer’s products. It could mean that retailers will not be able to stock these products until they come from licensed producers or perhaps that some retailers need to be licensed altogether. And it could mean that consumers wouldn't be able to purchase these products directly. It could also mean that effective immediately, all of these producers and retailers will have to cease business until they receive the proper licensing, which will take several months to get if they’re located in South Carolina and the money to get their facilities up to code, and only several weeks to get if they’re a producer located out of state. So, until then, no sales, i.e., no money. In this scenario, it wanted to, SCDOR could declare all NA beer and kombucha that have come from unlicensed producers or are sold by unlicensed retailers as contraband and could seize it and sell it. Also, because all of these producers and retailers could be deemed to have been violating the law all along, SCDOR could deny their applications for permits when they were submitted. Hopefully, that doesn’t happen and surely, SCDOR doesn't want to put people out of business. But regardless, a lull could be coming. But, besides a pause in production and sales, there could be some dramatic changes for these kinds of businesses and how they operate. You see, if they were brought under the alcohol code, they would be subject to all of the provisions of the alcohol code that they haven’t been doing before. That means that for producers, if everything applies as it does to normal alcohol producers:

In the case of retailers, remember, the statute also said those who "sell." So, this could have impact on distributors and retailers as well. Now, most are probably already licensed, so it isn't a concern. However, if a distributor or retailer only sold these kinds of beverages and wasn't licensed, then that could be an issue. And there are a lot more retailers out there than there are producers. For retailers, licensing would be required, as well as the payment of tax. On the other hand, there's a scenario where SCDOR creates a specific permit for these producers and/or retailers and doesn't require the payment of tax on something nonalcoholic, although that probably would only apply to excise tax and not retail sales tax. It could then have the authority to create regulations specifically tailored to these kinds of producers and/or retailers and what they're able to do and what they're required to do by law. What would that look like? It's anyone's guess. But, if they followed the TTB's lead, it would mean that only products above the 0.5% marker would get taxed for excise and have regulation put on them. Unfortunately, the South Carolina statutes don't have a minimum, so the regulators would have to go based upon what the law actually says. Regardless, we can probably expect some additional guidance down the road. WHAT COULD HAPPEN & WHAT YOU CAN DOLook, the statutes are what they are. And haven't been brought out into the light until now. But there’s no doubt that there could be a legislative fix to keep what has been the status quo. All that would be needed would be to set a minimum alcohol content for regulation in S.C. Code Ann. 61-4-10. Additionally or alternatively, legislators could eliminate S.C. Code Ann. 61-4-500 which makes nonalcoholic makers or retailers get licensing from SCDOR. As the session winds down in Columbia at the General Assembly, there isn’t time for a stand alone bill. So, anything of that sort would have to be tucked into a bill regarding alcohol to even become law. And there aren't a whole lot of those available at the moment. So, if it doesn’t happen, then this is the new reality. If this is an issue that you’re concerned about, then you can always contact your State Senator or Representative. If you don’t know who your legislators are, then you can use this tool: http://www.scstatehouse.gov/legislatorssearch.php BROOK BRISTOWBrook Bristow is a South Carolina-based lawyer at Bristow Beverage Law, who primarily counsels companies in the alcohol industry on business and employment laws, as well as on compliance, licensing, and intellectual property. You may reach him directly at [email protected]

When living the dream becomes a nightmare...It’s finally happening. You’ve spent years perfecting your craft, you’ve designed the perfect branding concept that’s unique to your vision, and you’re ready to open your own production facility. The last thing you need to do is make your brand official by registering your trademark. Then it happens, your trademark application is denied. Why? It turns out that some minute detail of your brand—a color, a symbol, maybe just a word—is too similar to another brand in a similar industry. Sure, you can open without trademarking your brand but, depending on your location and distribution range, it’s just a matter of time before the entity with the officially trademarked brand tells you to cease and desist because you’re infringing on their trademark. Then, you’ll find yourself in a position where you have two options and neither of them are good—risk legal action or rebrand. This is a nightmare, true, but there’s good news—you can keep this same scenario from happening to you by completing trademark clearance BEFORE you decide on branding. What is trademark ‘clearance’?Clearance is the process of searching multiple trademark databases, including federal and state databases, to determine if anyone else is using a similar mark on similar goods. Running clearance checks can help you assess and avoid any potential risk factors to your mark’s successful registration. Can anyone conduct trademark clearance?Yup! Anyone can conduct clearance searches, the trick is knowing what you’re looking for, how to properly construct a search query, and figuring out what other databases will also need to be searched. How do I conduct trademark clearance?We recommend starting with the USPTO Trademark Electronic Search System (TESS). This will allow you to easily see if another similar brand has already been trademarked or has an application pending. The downside is that this is just the tip of the iceberg. Even if a trademark is registered and protected, it may not appear in TESS because it was registered with another entity, possibly outside the country or in a different state. With that in mind, you’ll need to determine which additional databases would need to be queried based on your industry, location, and distribution range, just to make a few potential factors to keep in mind. And outside of the official database, you’ll also need to check on any other possibilities of current or past use by others. This seems complicated and super boring...We hear you and you’re not wrong. While searching a database sounds pretty straightforward, this is the government we’re dealing with, so many aspects of trademark clearance and even the registration process can be anything but.

If you’re concerned about potential branding issues, we’re here to help and encourage you to contact us. While no one can guarantee you a trademark approval, not even dedicated trademark lawyers, we can help you avoid common trademark registration pitfalls and determine which additional databases should be queried before you apply. DISCLAIMER: This post does not constitute legal advice. It merely sums up changes in the alcohol beverage laws to assist businesses in planning for the changes. If you have questions, then please speak to your legal professional. INTRODUCTIONSo, do you remember reading this past spring about the Gallo Winery pushing for law changes to come to South Carolina? Well, that happened. But, there was also another part of that bill that was tucked away. It’s called the South Carolina Micro-distillery Parity Act. Based on the title, you can imagine what the point of the legislation was. Since 2013 and 2014 with the passage of the Pint Law and Stone Law, distilleries have watched breweries become an economic juggernaut as well as being the places to go - sometimes at their expense. They’ve also seen very slow changes to the evolution of their own laws. But, the Parity Act sought to change all of that. SO, WHAT DOES IT DO?In a way, it’s like the Stone Law for South Carolina distillers. And like the Stone Law did, it really creates two kinds of distilleries. Effectively, it comes down to starting a DHEC kitchen space and serving food. If you are able to offer that, then you are eligible to get a beer/wine license from SCDOR, as well as another liquor permit so you can serve other spirits. Which are the same permits that breweries are able to get in addition to their brewery permit. Interesting side note: wineries are now the only producers in South Carolina who aren’t able to sell anything other than their products. Here’s what each type of distillery can now do: DISTILLERIES WHO SERVE FOOD AND OPT FOR ADDITIONAL PERMITS

DISTILLERIES WHO DON’T SERVE FOOD

Catch all that? So, distilleries who add a food component get the benefit of adding licenses which allow them to expand hours and offerings. But, they still will follow liquor state to-go rules on Sundays.

There are quite a few odds and ends in the bill, but basically, it’s a huge win for distillers. And as we always say to our brewers who take advantage of the Stone Law, its free money if you do it. Having greater flexibility in operating your business and in what you can offer to your consumers is always a win. You can read the new law here. Feel free to reach out if you have questions. |

AuthorBrook Bristow is a South Carolina-based lawyer at Bristow Beverage Law, who primarily counsels companies in the alcohol industry on business and employment laws, as well as on compliance, licensing, & intellectual property. You may reach him directly at: [email protected] Archives

April 2024

Categories |

RSS Feed

RSS Feed