|

DISCLAIMER: This post does not constitute legal advice and is presented for information, education, or entertainment purposes. It is opinion and commentary, and merely attempts to review the alcohol beverage laws and their interpretation to assist businesses in planning. If you have questions, then please speak to your legal professional or the appropriate regulation authority. Like many, over the last week, you might have heard that non-alcoholic beer maker Athletic Brewing Co. suspended direct-to-consumer shipping of its NA beers to South Carolina due to “the recent legal interpretation by state officials on the unique definition of non-alcoholic beer.” Many were left scratching their heads and complaining about those darn archaic SC alcohol laws once again. But, that left some questions open: (1) What statute? (2) What interpretation? (3) What does this all mean going forward for NA producers like Athletic and other low alcohol producers, such as kombucha makers, their distributors, and retailers? We’d like to tackle that in this blog. BACKGROUNDThe statute at issue is S.C. Code Ann. 61-4-10, which defines what are considered to be nonalcoholic beverages in South Carolina. It reads as follows: The following are declared to be nonalcoholic and nonintoxicating beverages: (1) all beers, ales, porters, and other similar malt or fermented beverages containing not in excess of five percent of alcohol by weight; (2) all beers, ales, porters, and other similar malt or fermented beverages containing more than five percent but less than fourteen percent of alcohol by weight that are manufactured, distributed, or sold in containers of six and one-half ounces or more or the metric equivalent; and (3) all wines containing not in excess of twenty-one percent of alcohol by volume. Did that make sense? The statute says that that any beer below 6.5% ABV (5% ABW) is considered nonalcoholic? And beers packaged in 6.5 ounce containers up to 17.5% ABW (14% ABW) are considered nonalcoholic? And wines not in excess of 21% ABV are considered nonalcoholic? Huh? Yeah. It’s a little weird, right? All of those beverages clearly contain alcohol, so why would we consider them to be nonalcoholic? Well, we’ll leave that discussion for another day as it is definitely confusing on the surface. For the purposes of this discussion, however, let’s focus on the fact that it says “all beers . . . or fermented beverages containing not in excess” of 5% ABW as being nonalcoholic. Now, perhaps there’s some enterprising future business owners out there that read that and think, “Hey, why I don’t start making kombucha or a brewery featuring only session beers and not have to worry about licensing or taxes?” Well, that’s where the other part of this comes into play. There’s another statute: S.C. Code Ann. 61-4-500. And it says that “a person engaging in the business of selling beer, ale, porter, wine, or a beverage which has been declared to be nonalcoholic and nonintoxicating under Section 61‑4‑10 must apply to the department for a permit to sell these beverages.” In other words, if you want to sell nonalcoholic products, then you’re going to be regulated by the alcohol code, and you’ll need a permit from SCDOR to do that. And that’s exactly what SCDOR is saying in its interpretation. Side Note: this statute is also deemed to be what legalizes homebrewing and winemaking in South Carolina. But notice, while it legalizes wine up to near fortified status, legally, any homebrewed beer can only be up to 6.5% ABV. I did a blog on this years ago that has since gone away, but perhaps we’ll have a discussion about it soon. THE INTERPRETATION AT ISSUEWhile there isn’t an official communication or policy statement, SCDOR has apparently adopted internal guidance that has been provided to certain folks in the industry that says that the above two statutes bring NA beer and kombucha under their umbrella. That basically says that regulation starts at 0.0% ABV, because South Carolina statute doesn’t set a minimum threshold for alcohol content. So, in SCDOR’s alleged view, you are subject to regulation even if the alcohol content in the produced beer or fermented beverage is zero or small and/or you want to sell such beverages. Now again, this isn't official or published, but appears to be where things are headed. Perhaps something will be released soon. So, in summary:

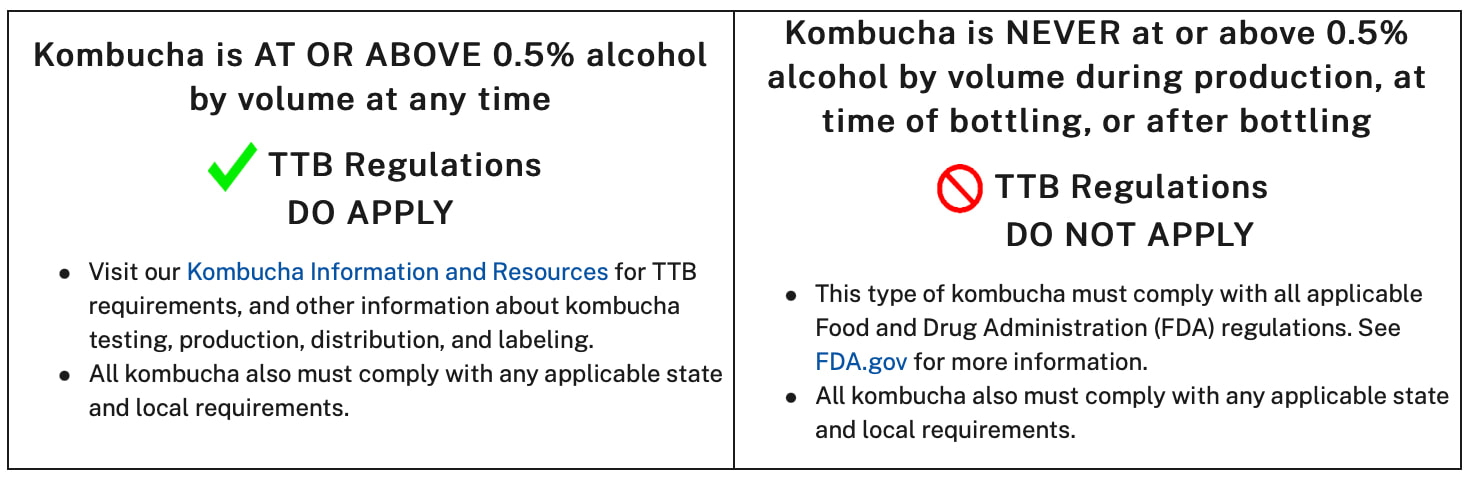

BUT WHY KOMBUCHA?Why are we grouping kombucha with beer? Well, under the federal law, that’s how it is treated, so that’s what SC would do as well since our laws are silent on it by name. What’s most interesting about kombucha is that, if it’s under 0.5% ABV, then the Alcohol and Tobacco Tax and Trade Bureau ("TTB"), the federal entity that regulates breweries and alcohol as a whole, doesn’t regulate kombucha makers or make them subject to its regulations or require licensing. So, someone could potentially only have a state brewery permit and pay taxes to South Carolina, but yet have no responsibility to the federal government for the exact same thing on a product that isn’t even 0.5% ABV. But other fermented beverages would also fall under this interpretation as well. This could also complicate things for out-of-state producers, as they are required by the South Carolina application to provide their TTB approval. So, potentially, they could have to apply for a federal approval even if their products don't fall under the TTB's purview. That might not be worth it for them. Something else to consider: while this post isn't intended to be a full legal analysis, there is one item worth noting. The 21st Amendment. Yes, it repealed prohibition. But it also gave nearly complete authority over alcohol regulation to the states. But, many recent court cases giving interpretation to this have made clear that the authority of states is limited by various parts of the Constitution and only extend to "intoxicating liquors." The question would be are NA products and products under 0.5% which are not federally regulated considered alcohol enough to allow states the authority to regulate them under their alcohol regulatory powers? It's a very interesting question to pose here. WHAT DOES THIS MEAN AND WHAT COULD BE CHANGING?NOTE: SCDOR hasn’t confirmed anything yet beyond registration, but one would think if these businesses have brewery or beer producer permits, then they’d be treated as other breweries are which are subject to those same laws regardless of ABV for products. It's also possible a new permit is created for NA businesses. But that remains to be seen. There's also some interplay with the Department of Agriculture. They are the regulators for cottage foods - i.e., certain products that are made at home and sold at farmers markets directly to consumer. What’s a worst case scenario? Well, if beyond registration, alcohol laws are applied to them, then that could mean that producers need to cease production and sales. It could mean that their distributors won’t be able to sell any more of the producer’s products. It could mean that retailers will not be able to stock these products until they come from licensed producers or perhaps that some retailers need to be licensed altogether. And it could mean that consumers wouldn't be able to purchase these products directly. It could also mean that effective immediately, all of these producers and retailers will have to cease business until they receive the proper licensing, which will take several months to get if they’re located in South Carolina and the money to get their facilities up to code, and only several weeks to get if they’re a producer located out of state. So, until then, no sales, i.e., no money. In this scenario, it wanted to, SCDOR could declare all NA beer and kombucha that have come from unlicensed producers or are sold by unlicensed retailers as contraband and could seize it and sell it. Also, because all of these producers and retailers could be deemed to have been violating the law all along, SCDOR could deny their applications for permits when they were submitted. Hopefully, that doesn’t happen and surely, SCDOR doesn't want to put people out of business. But regardless, a lull could be coming. But, besides a pause in production and sales, there could be some dramatic changes for these kinds of businesses and how they operate. You see, if they were brought under the alcohol code, they would be subject to all of the provisions of the alcohol code that they haven’t been doing before. That means that for producers, if everything applies as it does to normal alcohol producers:

In the case of retailers, remember, the statute also said those who "sell." So, this could have impact on distributors and retailers as well. Now, most are probably already licensed, so it isn't a concern. However, if a distributor or retailer only sold these kinds of beverages and wasn't licensed, then that could be an issue. And there are a lot more retailers out there than there are producers. For retailers, licensing would be required, as well as the payment of tax. On the other hand, there's a scenario where SCDOR creates a specific permit for these producers and/or retailers and doesn't require the payment of tax on something nonalcoholic, although that probably would only apply to excise tax and not retail sales tax. It could then have the authority to create regulations specifically tailored to these kinds of producers and/or retailers and what they're able to do and what they're required to do by law. What would that look like? It's anyone's guess. But, if they followed the TTB's lead, it would mean that only products above the 0.5% marker would get taxed for excise and have regulation put on them. Unfortunately, the South Carolina statutes don't have a minimum, so the regulators would have to go based upon what the law actually says. Regardless, we can probably expect some additional guidance down the road. WHAT COULD HAPPEN & WHAT YOU CAN DOLook, the statutes are what they are. And haven't been brought out into the light until now. But there’s no doubt that there could be a legislative fix to keep what has been the status quo. All that would be needed would be to set a minimum alcohol content for regulation in S.C. Code Ann. 61-4-10. Additionally or alternatively, legislators could eliminate S.C. Code Ann. 61-4-500 which makes nonalcoholic makers or retailers get licensing from SCDOR. As the session winds down in Columbia at the General Assembly, there isn’t time for a stand alone bill. So, anything of that sort would have to be tucked into a bill regarding alcohol to even become law. And there aren't a whole lot of those available at the moment. So, if it doesn’t happen, then this is the new reality. If this is an issue that you’re concerned about, then you can always contact your State Senator or Representative. If you don’t know who your legislators are, then you can use this tool: http://www.scstatehouse.gov/legislatorssearch.php BROOK BRISTOWBrook Bristow is a South Carolina-based lawyer at Bristow Beverage Law, who primarily counsels companies in the alcohol industry on business and employment laws, as well as on compliance, licensing, and intellectual property. You may reach him directly at [email protected]

4 Comments

|

AuthorBrook Bristow is a South Carolina-based lawyer at Bristow Beverage Law, who primarily counsels companies in the alcohol industry on business and employment laws, as well as on compliance, licensing, & intellectual property. You may reach him directly at: [email protected] Archives

April 2024

Categories |

RSS Feed

RSS Feed